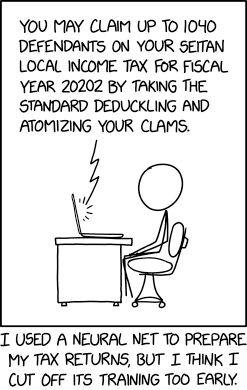

Tax AI

I ended up getting my tax return prepared at a local place by a really friendly pretrained neural net named Greg.

I ended up getting my tax return prepared at a local place by a really friendly pretrained neural net named Greg.

The deadline for filing tax returns in the United States is April 15, so many people in the US are already in the process of filing their taxes at the time of this comic's publication. Traditionally, people used tax provider companies, but it is becoming more popular to use tax preparation software, such as TurboTax or a service from the Free File Alliance, which helps to fill in the tax forms after a user enters their income information and deductions for the year.

In this comic, Cueball has attempted to train an artificial neural net to prepare his US tax return, but it has made several comical errors, purportedly because it was not trained extensively enough. Most of the errors consist of malapropisms, words that sound almost the same but mean very different things switched for comic effect. This suggests Cueball trained the neural net by talking to it.

The title text references 2173: Trained a Neural Net, which indicates that getting a human to do something is basically using a "pretrained neural net". Cueball has chosen to use a local tax provider to help him file his taxes, aka a "pretrained neural net" in the form of a human named Greg.

Randall also "trained" humans to do his tax returns in 1566: Board Game. Tax returns and the troubles of filling them out were also the subjects of 1971: Personal Data and 1977: Paperwork.

Types of errors

- "claim up to 1040 defendants": typically, taxpayers may claim "dependents" (not "defendants", persons being sued or accused of crimes) to deduct a certain amount of money from their taxable income, which is intended to represent money used for their care. Dependents include children, wards, elderly parents, and others for whom the taxpayer is the primary caregiver, so 1040 would be an absurdly high number. Form 1040 is the number of the primary tax document that must be filed in the United States.

- "seitan local income tax" is a reference to "state and local income tax" which can be deducted from federal income taxes in the US. Most states in the United States have income taxes that must be prepared separately, but some do not. In English, seitan is another name for wheat gluten, used in vegetarian or vegan dishes. This is most likely a byproduct of the AI mishearing "state and" as "seitan".

- "fiscal year 20202": presumably the neural net got carried away with 2's and 0's in 2020. However, at the date the comic was published, Cueball should be filing his 2019 taxes anyway. Alternately, the comic could take place in the future and it took the way most people will speak the year 2022 ("twenty twenty-two") and then transferred this directly to numbers ("20" "20" "2" becoming 20202).

- "standard deduckling" : the "standard deduction", which is what many taxpayers opt to do rather than attempting to itemize their deductions. The standard deduction is based on filing status and typically increases each year. "Deduckling" is not a word, but "duckling" is: namely, a baby duck.

- "atomizing" his "clams": instead of "itemizing his claims" which, as mentioned above, wouldn't make sense if he was taking the standard deduction anyway. Itemized deductions means to "itemize" or list individual deductions, such as charitable donations, medical expenses, mortgage interest payments, etc. Choosing to itemize deductions may lead to a greater deduction, but requires more effort and supporting documentation, in case of a tax audit. Alternatively, it could be referencing the term "Liquidating finances."